How To Add Liquidity To Deliciouswap Liquidity Pool: A Step to Step Guide

DSP Network

—How To Add Liquidity To Deliciouswap Liquidity Pool: A Step to Step Guide

The Delicious Liquidity Pool

In this article, we will guide you on how to add and remove liquidity in Deliciouswap liquidity pool. Firstly, we shall discuss how they work and whether it is suitable for everyone or a particular group of people. Deliciouswap is a decentralized ERC-20 exchange, but it is not designed for tokens only; it also supports Ethereum. We can also see Deliciouswap as an exchange protocol that permits you to trustlessly exchange ERC-20 tokens.

Deliciouswap Liquidity pool gather tokens in a smart contract model, and users trade against the liquidity pool. On Deliciouswap, you or anybody can easily swap tokens; add tokens to a pool to earn some fees. You can also list a token on Deliciouswap.

The good thing about the Deliciouswap platform is that you can easily exchange Ethereum for any ERC-20 token. This exchange happens in a decentralized manner. You are not dealing with any company, there is no KYC involved in.

The exchange and there is no intermediary facilitating these transactions.

Centralized platforms hold your money, and they charge you for holding your money, but the Deliciouswap platform is the opposite. Deliciouswap is a decentralized exchange where you always have complete control of your money. Once you initiate a transaction, it immediately takes the money out of your wallet and puts it back in another format. This is how it ensures that there is no censorship.

Yield farming on Deliciouswap

Yield farming allows you to make more money with your crypto assets. To do that, you have to become a liquidity provider. Deliciouswap allows you to become a liquidity provider.

Delicisouswap Fee

Concurrently, on signing up on the platform, you are sharing 0.1% of the transaction fees on the pools. Therefore, if you provide, say, 40% liquidity to liquidity pool then you will earn 40% of the transaction fee.

How Deliciouswap Liquidity Pool works

We will go further to explain the functionality of the Deliciouswap Liquidity pool. The liquidity pools are an aggregation of tokens in smart contracts. In this liquidity pool, there are enough ERC-20 tokens for you to swap, and Pool with another. It is noteworthy that Ethereum serves as the conduit. This means that the pool contains a high number of Ethereum and other ERC-20 tokens on the Deliciouswap exchange. Therefore, you can create a new exchange pair in a new liquidity pool for any token of your choice. Concurrently, It is entirely open to everyone.

For example, you can be part of the ETH/DAI liquidity pool. You will have to make an equal value of Ethereum and the ERC-20 token that you want to participate with. If you want to join in the ETH/DAI on Deliciouswap Liquidity pools, you must have the exact amount of both DAI and Ethereum simultaneously. Therefore when someone comes in and decides to trade DAI to Ethereum on Deliciouswap, your liquidity will be taped.

However, you could have an impermanent loss. This happens when your money tilts towards either Ethereum or DAI. Meanwhile, the impermanent depends on the trade that needs to take place at that time.

If someone wants to trade Ethereum in exchange for DAI, your DAI liquidity might shrink while Ethereum liquidity goes up. If your DAI goes down by a dollar, your Ethereum should go up by the same margin. This is the way that the Deliciouswap Liquidity Pool work.

How to Do Yield Farming on Deliciouswap

You will see “clickable” buttons like Swap and Pool on the exchange platform. The “pool” is where you can either add liquidity, remove liquidity, or create your exchange pair. Deliciouswap is designed so that you can add or remove the liquidity pool on the platform. We will explain how you can carry out these tasks without running into any trouble along the line.

How to Create Liquidity Pool on Deliciouswap

Creating a liquidity pool is similar to creating your own exchange. This allows you to control your tokens. Here are steps on how to create a pool:

Start by visiting the website.

Select “connect wallet” to connect Deliciouswap to your account.

Click on the Pool tab.

Go through the dropdown, to select the liquidity pool (token pair) you want to be part of.

Copy your token’s contract address (from Etherscan for example).

Paste the address on the Token Address field, and select it from the dropdown.

Click on the “Create pool” button.

Wallet notification popup shows, click on the Confirm button

How to Add Liquidity Pool to Deliciouswap Liquidity Pool

Before adding a liquidity pool, below are steps to follow. More so, there are basic requirements, for instance; MetaMask or other Web3 wallets and tokens. Concurrently, you can find the steps herein;

- All you have to do is log on to the site of Deliciouswap (https://app.deliciouswap.com/). When done, click on “Pool” to navigate the interface for adding liquidity.

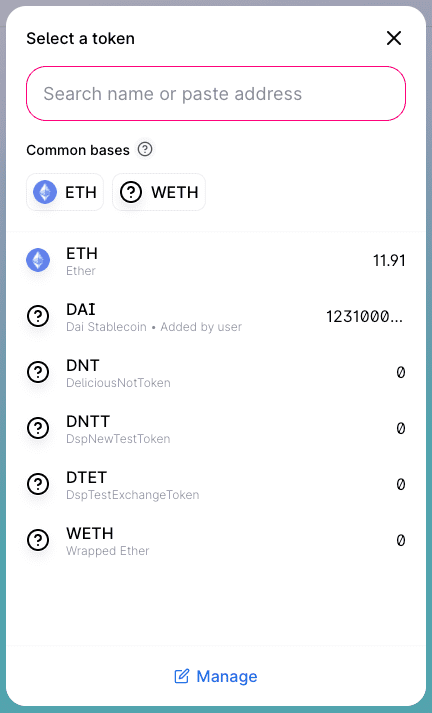

Click “Add Liquidity”. Go through the dropdown to search for pools.

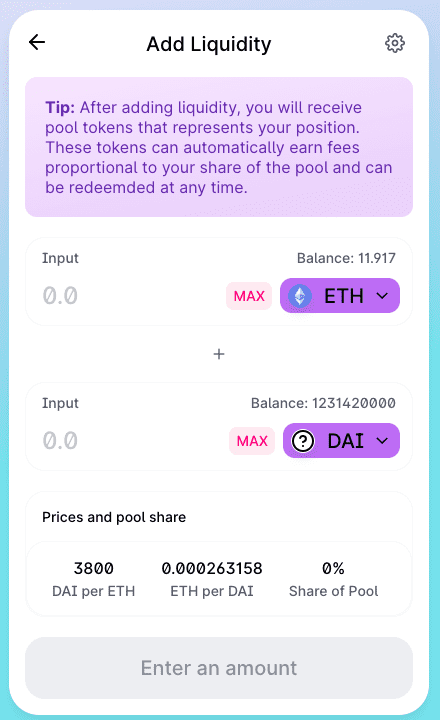

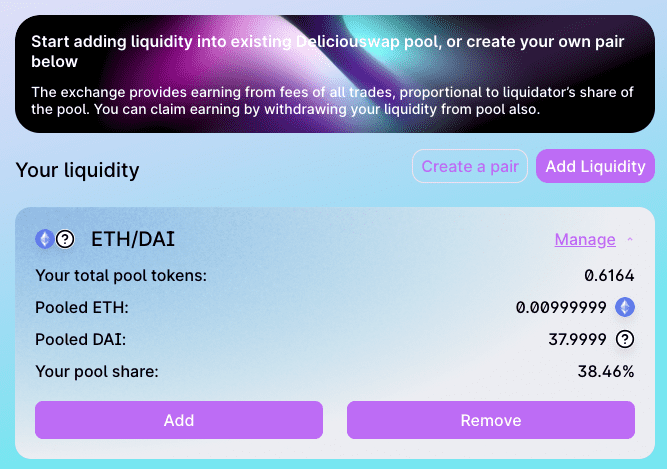

Deliciouswap will show you the balance found on your connected wallets (ETH and other ERC-20 tokens). You will also see the exchange rate and the share of the liquidity pool.

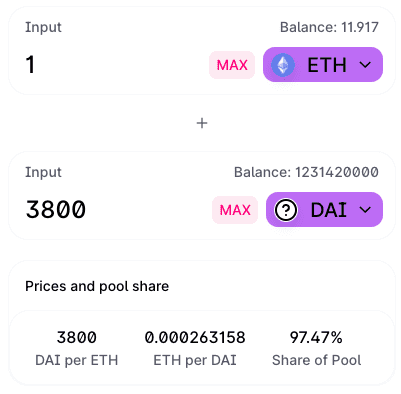

- Say you want to add liquidity in ETH/DAI pool. After you enter the ETH or DAI value, Deliciouswap will autofill the correct amount of the other assets depending on the current exchange rate.

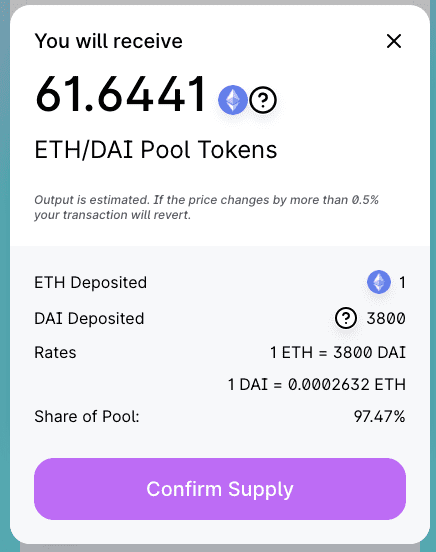

- After entering the token amount you want to add, you can click on “Supply” to see more transaction details, such as the number of ETH/DAI Pool Tokens you will be minting. The details will also come with the value of the tokens you want to mint.

Now you click the blue “Confirm Supply” button. For those of you using the MetaMask wallet, you can adjust the gas and then click “confirm.”

Once the transaction has been confirmed on the Ethereumblockchain, you are done with your task. You will see your updated ETH and DAI balances and your share of the trading pair’s total liquidity pool.

How to Remove Liquidity on Deliciouswap Liquidity Pool

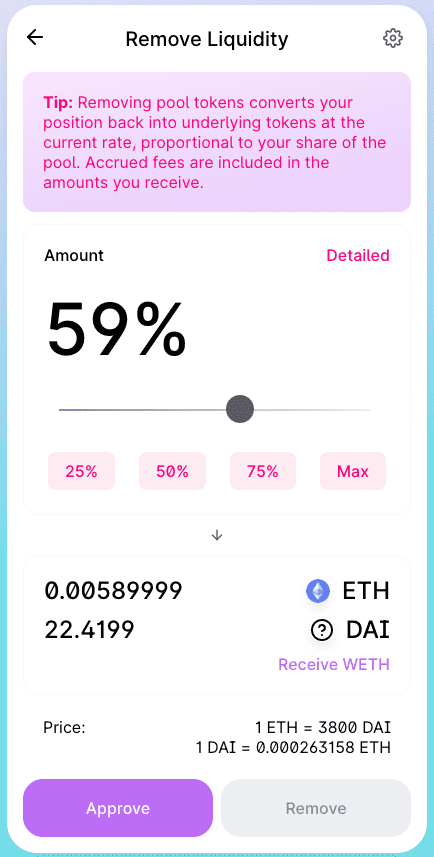

Before you can remove liquidity on Deliciouswap, click on “Pool” to see the pair that you provided liquidity, and click “Manage”.

Click ‘Remove’ on the interface.

Select the amount of liquidity to remove that you wish to withdraw from the Deliciouswap Liquidity pools.

Approve and confirm the removal.

Confirm the transaction.

Proceed with final confirmation.

FAQs

What are Liquidity Pools?

They are pools of tokens locked in a smart contract to facilitate liquidity. Typically, the function of liquidity pools is to allow traders to trade their digital assets while earning rewards on their asset holdings.

How to make money with Deliciouswap pools?

You can make money as a liquidity provider at Deliciouswap, proportional to your share of the pool and you can be redeemed at any time.

How do you calculate pool liquidity?

Use X*Y =K to determine the pool liquidity. X, Y and K represents the value of ETH, ERC-20 token and Constant respectively. The above equation represents demand and supply of ETH/ERC-20 token and it uses that to balance the price of pooled token.

What are the liquidity risks?

- Impairment loss

- fees

- posible smart contract bugs

Please kindly share your questions and thoughts with us.